Artificial intelligence (A.I.) is infiltrating finance, with algorithms analyzing massive datasets and executing trades at lightning speed. This begs the question: Will A.I. trading eventually outsmart human traders?

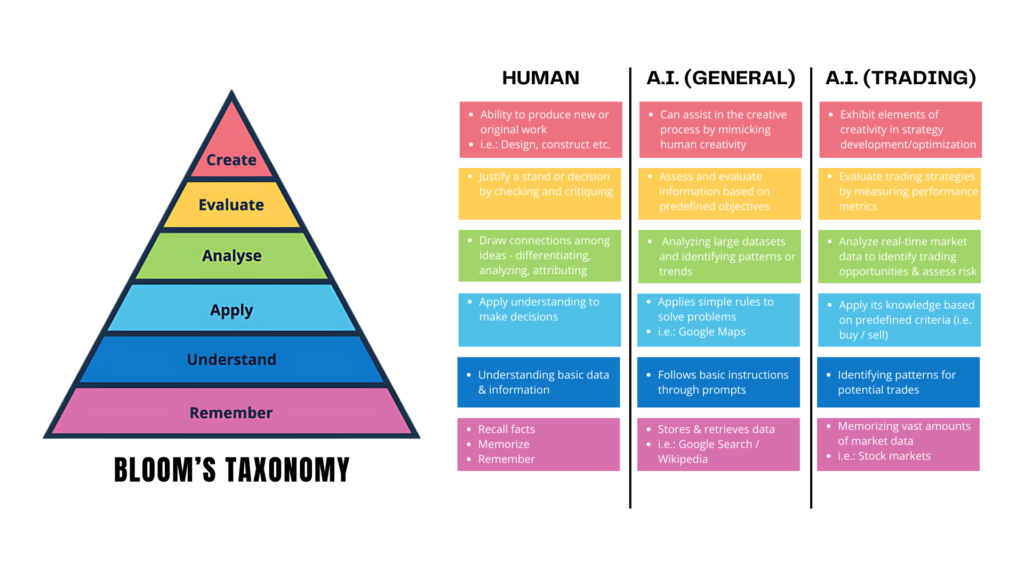

The answer isn’t a simple yes or no. Both A.I. and humans bring unique strengths to the table. Bloom’s Taxonomy, a framework for categorizing human thinking skills, helps us understand this.

A.I. Revolutionizing Trading

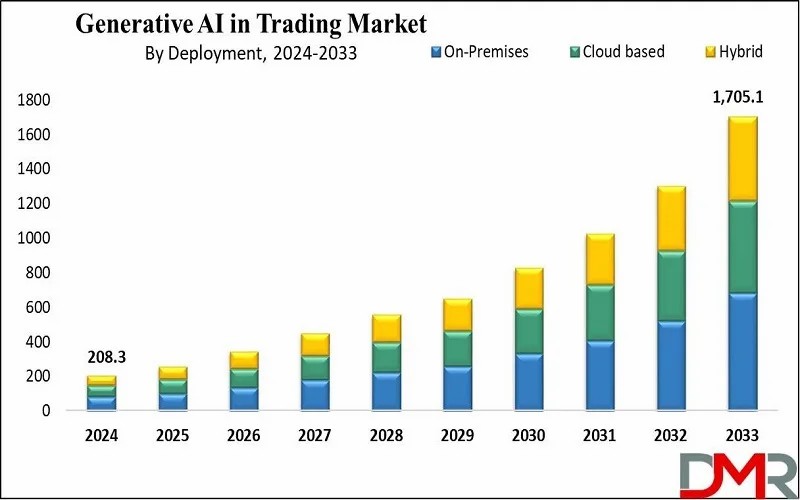

Source: Dimension Market Research

According to a very recent 2024 Yahoo Finance article, the global generative A.I. in trading market size is expected to reach USD 208.3 million by 2024 and is further anticipated to reach USD 1,705.1 million by 2033, according to Dimension Market Research. The market is anticipated to register a CAGR of 26.3% from 2024 to 2033. This highlights A.I.’s growing role, but are these algorithms replacing human traders entirely? Not quite.

Humans vs A.I.: A Thinking Skills Showdown

Bloom’s Taxonomy outlines six levels of thinking, from remembering facts (lower-order) to evaluating complex situations and creating new ideas (higher-order). Here’s how humans and AI in general fare in each category, applied to both trading and technology itself:

Remembering & Understanding (Lower-Order Thinking):

- Human Traders: Humans can also remember and understand basic market data.

- General A.I.: Stores and retrieves vast information (remembering) and follows basic instructions (understanding).

- Trading A.I.: A.I. excels here, memorizing vast amounts of market data (remembering) and identifying patterns for potential trades (understanding).

Applying & Analyzing (Mid-Order Thinking):

- Human Traders: Humans can apply their understanding to make trading decisions (applying) and analyze data to identify not just trends, but also potential causes (analyzing).

- General A.I.: Applies simple rules to solve problems (applying) and analyzes basic data sets for trends (analyzing).

- Trading A.I.: A.I. can apply its knowledge to follow predefined trading rules (applying) and analyze data for opportunities. However, applying creative solutions or analyzing the “why” behind market movements can be a challenge for A.I.

Evaluating & Creating (Higher-Order Thinking):

- Human Traders: This is where humans shine. We can evaluate complex situations, considering economic and social factors (evaluating). We can also adapt strategies and even create entirely new investment approaches (creating) – think of legendary investors like Warren Buffett.

- General A.I.: Struggles with complex situations and requires human input for evaluation and creation.

- Trading A.I.: This is where A.I.’s limitations lie. It struggles to evaluate complex situations, considering underlying economic and social factors beyond data points (evaluating). Additionally, A.I. has difficulty creating entirely new trading strategies (creating).

The Future of Trading: Collaboration is Key

While A.I. might not replace human traders entirely, a future of collaboration seems more likely. Here’s how A.I. and humans can work together:

- A.I. analyzes massive datasets (Remembering) and identifies potential trades (Understanding).

- Humans evaluate the “why” behind the opportunity and assess its risk profile (Evaluating).

- Together, they make informed decisions about executing the trade (Applying).

- Over time, humans can even use A.I.’s insights to create entirely new investment strategies (Creating).

Conclusion: Humans Remain Essential

The future of trading is likely a partnership between A.I. and human intelligence. Humans will continue to provide higher order thinking skills like evaluation and creativity, while A.I. will act as a powerful tool for data analysis and trade execution. At this stage, A.I. cannot fully replace humans in every area, and trading is no exception. Whether you’re a seasoned investor or just starting out, staying informed about A.I.’s role in the market can help you make smarter investment decisions in the future.

Discover more about our A.I. trading software on our FREE webinar now!